After the labour force has officially been in the COVID-19 pandemic for over a year now, we’re examining how employment and demand in the seven key sectors in Windsor-Essex has changed as compared to the previous year.

To play with the data yourself, visit our Sectors in Windsor-Essex page. Each individual sector dashboard will be linked in its respective section below.

MENU:

Transportation & Warehousing Sector

The Transportation & Warehousing sector is comprised of businesses engaged in transporting passengers and goods, warehousing and storing goods, and providing services to these establishments. The modes of transportation are road (trucking, transit, and ground passenger), rail, water, air, and pipeline. National post office and courier establishments, which also transport goods, are included in this sector.

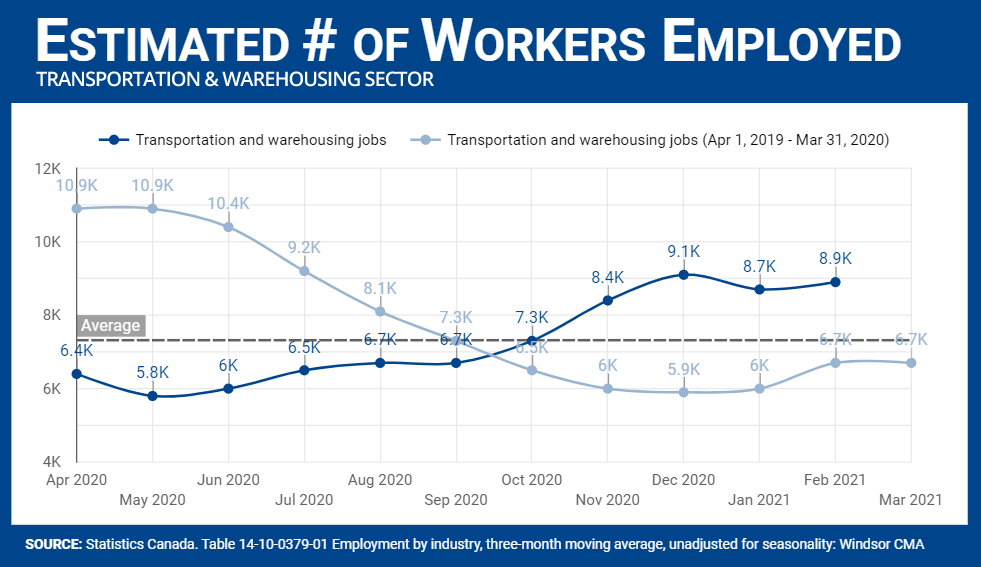

Employment in the Transportation & Warehousing sector has increased over the past year, with 8,900 employed in the sector as of February 2021 versus 6,700 in February 2020 for an increase of 32.84%.

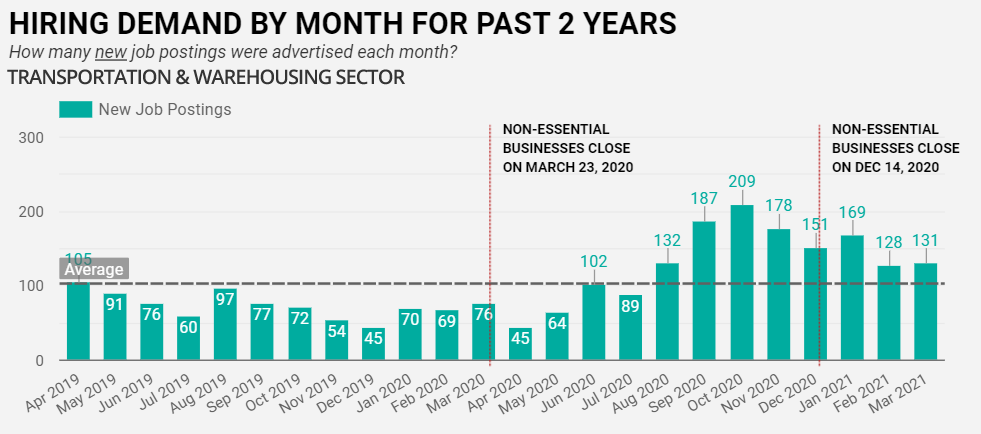

From April 2020 to March 2021, the Job Board saw 1,585 total job postings from 294 companies for the Transportation & Warehousing sector. This is an increase of 77.69% as compared to April 2019 to March 2020, which saw 892 total job postings from 241 companies.

This increase aligns with the changing habits of individuals purchasing goods online for delivery. The pivot in the Retail Trade and Accommodation & Food Services sectors for home delivery for packages and food and drink services are driving up the demand for the Transportation & Warehousing sector and related occupations. As the popularity of services such as delivery and curbside pickup (for retail goods and food and drink) increased, and more customers ordered goods online instead of in person at retail locations, the demand of jobs in the Transportation & Warehousing sector that support the delivery and transport of goods increased as well.

Looking at the hiring demand by month for the Transportation & Warehousing sector, there was a significant decrease in hiring as non-essential businesses closed on March 23, 2020. However, as the habits of businesses and consumers changed during the pandemic, and certain restrictions were eased or lifted, hiring in the sector increased, with October 2020 seeing the highest demand in the sector in two years.

Retail Trade Sector

The Retail Trade sector is comprised of establishments engaged in retailing merchandise (generally without transformation) and rendering services incidental to the sale of merchandise. This sector comprises two main types of retailers: store and non-store retailers.

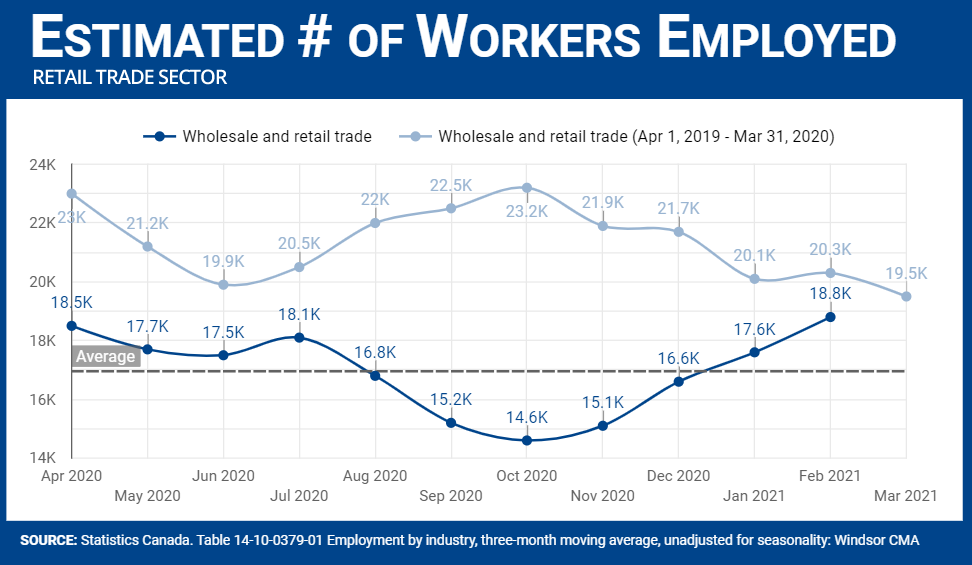

Employment in the Retail Trade sector has decreased over the past year, with 18,800 employed in the sector as of February 2021 versus 20,300 in February 2020, for a decrease of 7.98%. The largest gap in the number of employees in this sector occurred in October 2021, with 14,600 employed in Retail Trade versus 23,200 in October 2020, for a decrease of 58.9%.

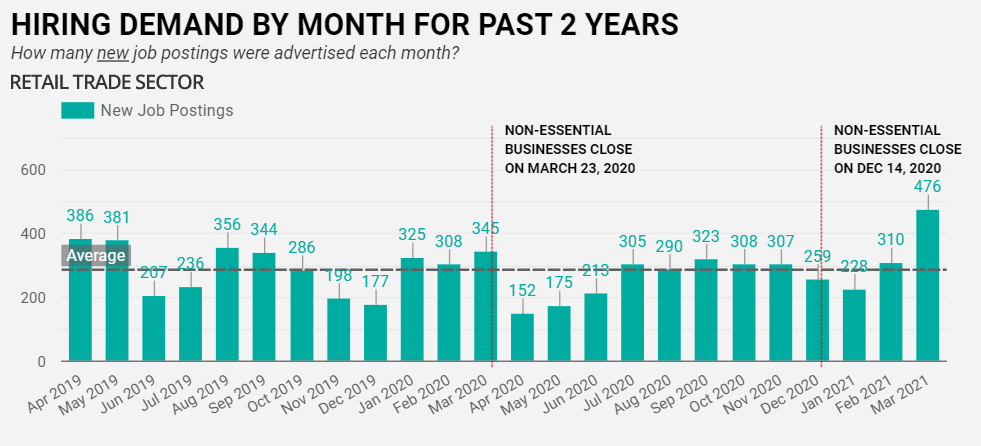

From April 2020 to March 2021, the Job Board saw 3,346 total job postings from 414 companies in the Retail Trade sector. This is a decrease of 6.07% as compared to April 2019 to March 2020, which saw 3,549 total job postings from 498 companies.

While hiring in the Retail Trade sector dropped during the pandemic as compared to the previous year, it did see a surge in demand after the first Stay at Home order was lifted in February 2021, which allowed non-essential retail to reopen for in-person shopping and customers could now leave their homes to shop. As many had been cooped up in their homes since December, there may have been an increase in retail shopping as many people were eager to leave their homes and return to some semblance of normalcy. This was short-lived with the second Stay at Home order on April 8, 2021, limiting retail to essential items in person, and curbside and delivery of goods only available within certain hours (7 a.m. to 8 p.m.).

Retail Trade has been one of the hardest hit sectors due to the pandemic, with the province restricting and closing non-essential retail. Additionally, consumer habits have shifted as more people become accustomed to ordering goods online instead of browsing in store.

Accommodation & Food Services Sector

The Accommodation & Food Services sector is comprised of establishments that provide short-term lodging and complementary services to travelers, vacationers, and others, as well as establishments that prepare meals, snacks, and beverages, to customer orders, for immediate consumption on and off premises.

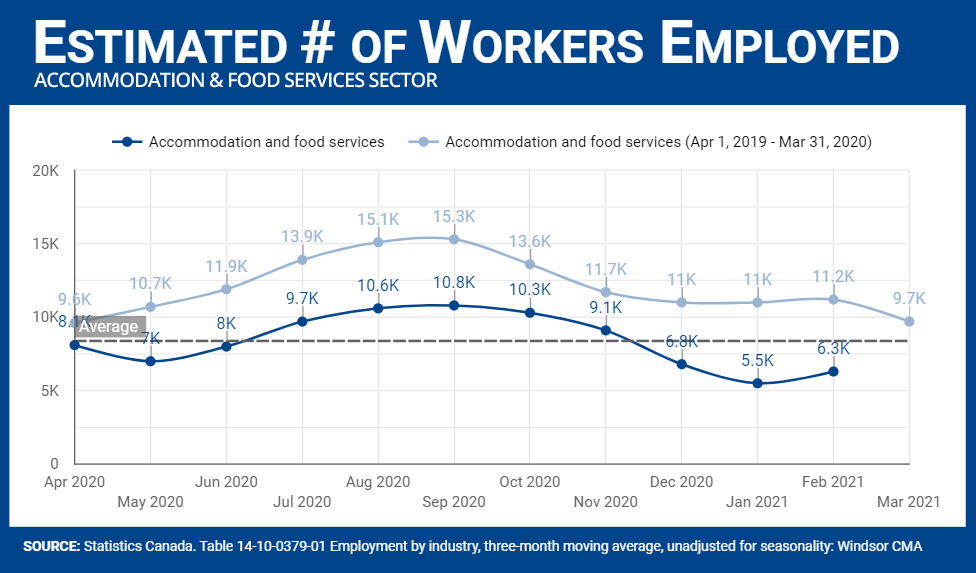

Employment in the Accommodation & Food Services sector has decreased over the past year, with 6,300 employed in the sector as of February 2021 versus 11,200 in February 2020, for a decrease of 77.78%.

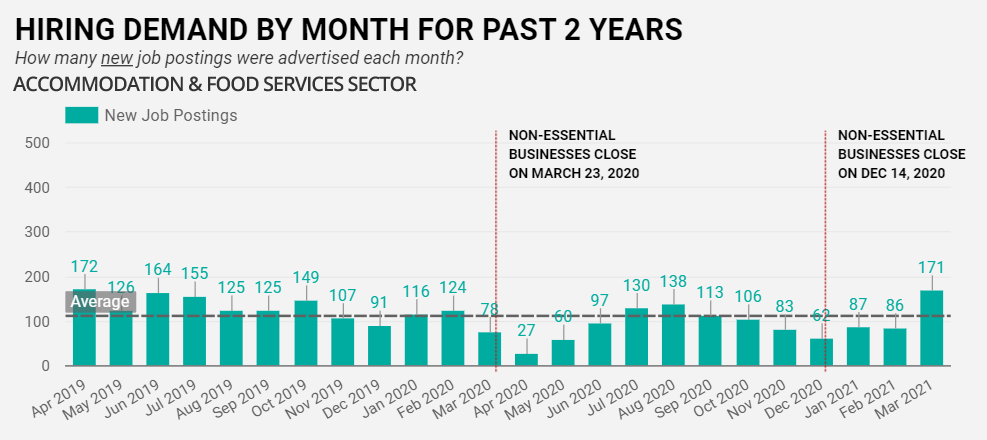

From April 2020 to March 2021, the Job Board saw 1,160 total job postings from 321 companies in the Accommodation & Food Services sector. This is a decrease of 32.07% as compared to April 2019-March 2020, which saw 1,532 total job postings from 379 companies.

With indoor and outdoor dining either limited or restricted completely during various times throughout the pandemic, the Accommodation & Food Services sector has had to pivot, offering curbside pickup, takeout, and delivery. As the sector also includes services to travelers and vacationers, this greatly impacts establishments like hotels, since not only is travel restricted, but the Canada-U.S. border is closed to non-essential travel, which is detrimental to a border region like Windsor-Essex that relies on U.S. customers.

The hiring demand for Accommodation & Food Services fell dramatically as the pandemic began and all non-essential businesses were ordered to close in March 2020. While demand in the sector gained some momentum in the warmer months when restaurants were able to accommodate outdoor and patio dining, it fell again in the colder months and throughout the province-wide Lockdown and Stay at Home order. Restrictions on indoor dining were partially eased in February, causing a rise in demand, but this will likely decrease as early April saw a province-wide Shutdown, Lockdown, and second Stay at Home order.

Information, Culture & Recreation Sector

The Information, Culture & Recreation sector is comprised of establishments engaged in operating facilities or providing services to meet the cultural, entertainment, and recreational interests of their patrons. It also includes establishments that produce and distribute (except by wholesale and retail methods) information and cultural products.

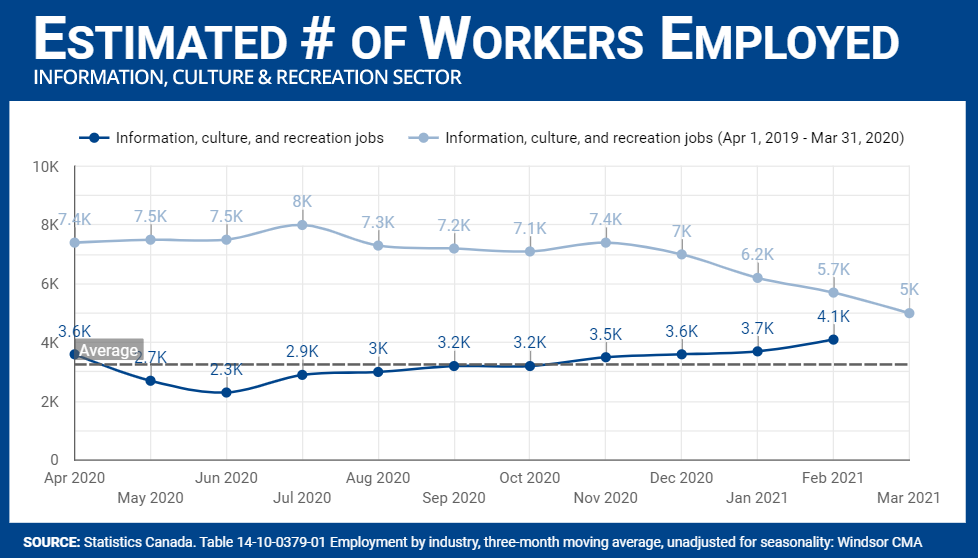

Employment in the Information, Culture & Recreation sector has decreased over the past year, with 4,100 employed in the sector as of February 2021 versus 5,700 in February 2020, for a decrease of 39.02%, although employment in the sector has been slowly increasing as the pandemic continues.

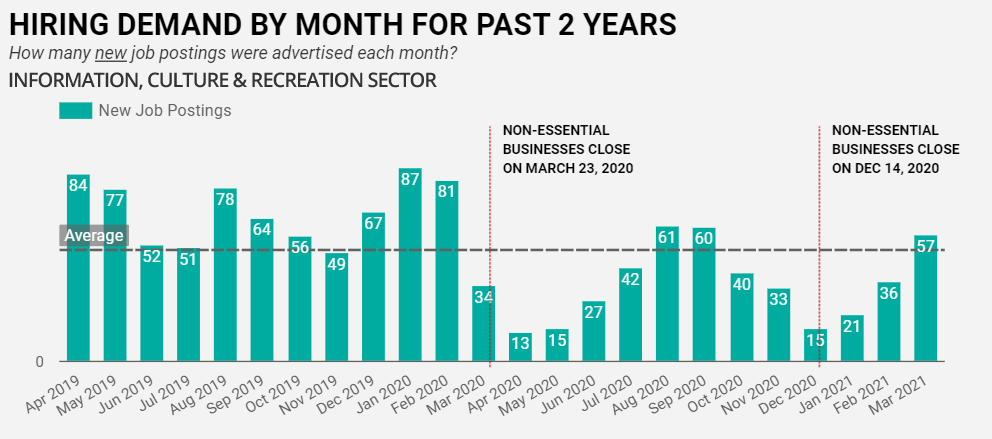

From April 2020 to March 2021, the Job Board saw 420 total job postings from 133 companies in the Information, Culture & Recreation sector. This is a decrease of 85.71% as compared to April 2019 to March 2020, which saw 780 total job postings from 187 companies.

The demand for jobs in the Information, Culture & Recreation sector have largely been below average during the pandemic, but rising steadily since December. As this sector is particularly hard hit by government Shutdown, Lockdown, and Stay at Home orders, the demand may decrease in the coming month.

Large employers in this sector include Caesars Windsor, which has not been able to reopen, save for a short period of time for a maximum of 50 guests in October 2020. This establishment alone employed 2,300 people in the region pre-pandemic. This sector also includes gyms, which have either been operating at a limited capacity to adhere to health measures or not open at all.

Educational Services Sector

The Educational Services sector is comprised of establishments that provide instruction and training in a wide variety of subjects. This instruction and training is provided by specialized establishments, such as schools, colleges, universities, and training centres. These establishments may be privately owned and operated, either for profit or not, or they may be publicly owned and operated. They may also offer food and accommodation services to their students.

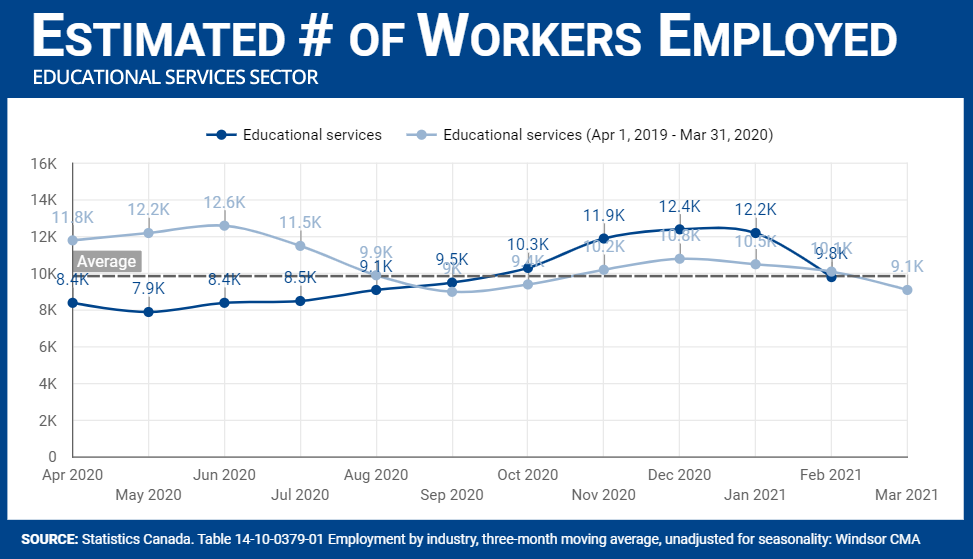

Employment in the Educational Services sector decreased at the beginning of the pandemic, as compared to the previous year, but has increased as of September 2020 when schools commenced for the new year, although it is sitting below last year’s numbers as of February 2021 (9,800 employed in the sector in February 2021 versus 10,000 in February 2020, for a decrease of 3.06%).

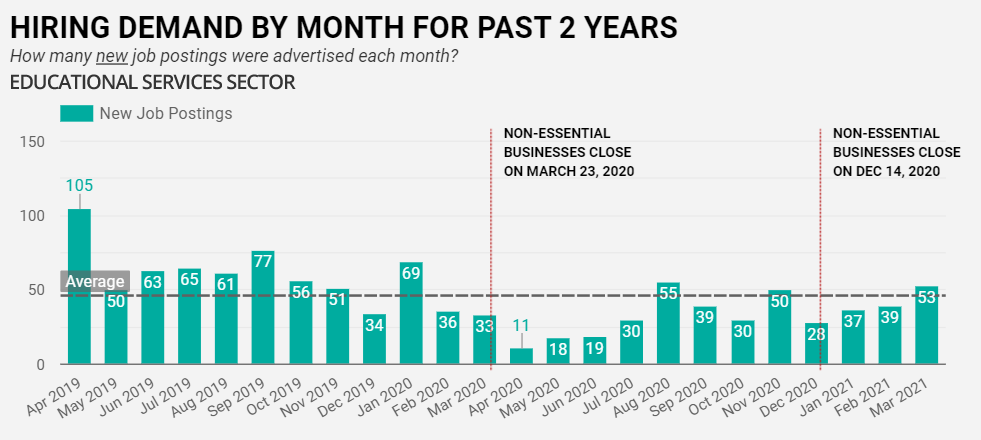

From April 2020 to March 2021, the Job Board saw 409 total job postings from 76 companies for the Educational Services sector. This is a decrease of 71.15% as compared to April 2019 to March 2020, which saw 700 total job postings from 105 companies.

April 2019 saw a high demand for jobs in the Educational Services sector, likely due to hiring for the new school year, summer classes and training, and additional tutoring services. The demand decreased dramatically for April 2020 as non-essential businesses closed and schools pivoted to online learning after an extended March break. Demand has increased to above average in August 2020, November 2020, and March 2021 as schools worked to accommodate online and in-person learning. December 2020 also saw schools in Windsor-Essex closed halfway through the month until January 11, 2021.

The increase in August and September 2020 may be due to needing additional teachers and resources in class and for teaching online as school boards worked to accommodate different learning platforms to adhere to health measures. Additionally, parents and students could find online and in-person learning challenging during these times and have sought out tutoring services as to not fall behind.

Health Care & Social Assistance Sector

The Health Care & Social Assistance sector is comprised of establishments that provide health care by diagnosis and treatment, provide residential care for medical and social reasons, and provide social assistance (such as counselling, welfare, child protection, community housing and food services, vocational rehabilitation, and child care) to those requiring such assistance.

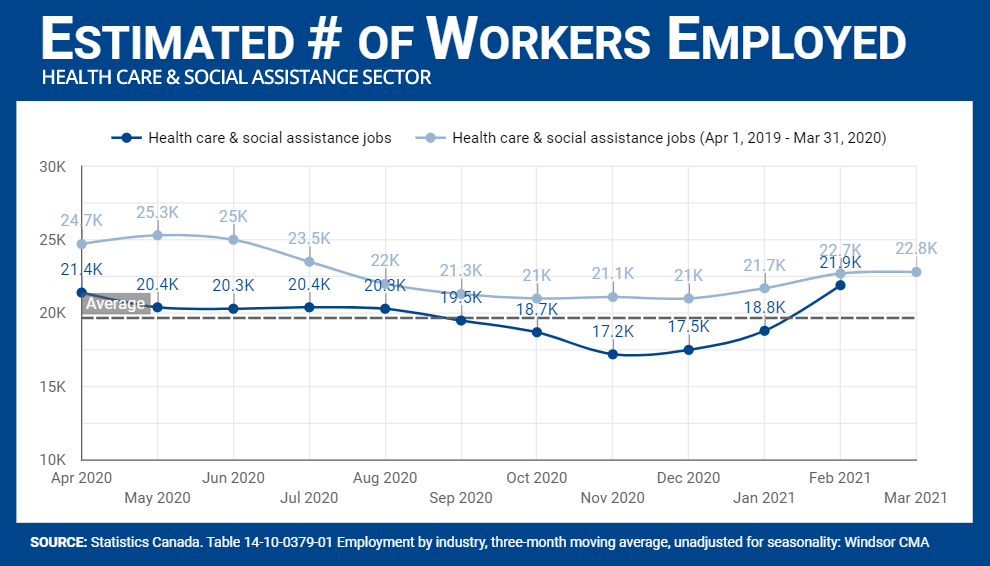

Employment in the Health Care & Social Assistance sector has decreased during the pandemic, although it is trending upward with 21,900 employed in the sector as of February 2021 versus 22,700 in February 2020, for a decrease of 3.65%.

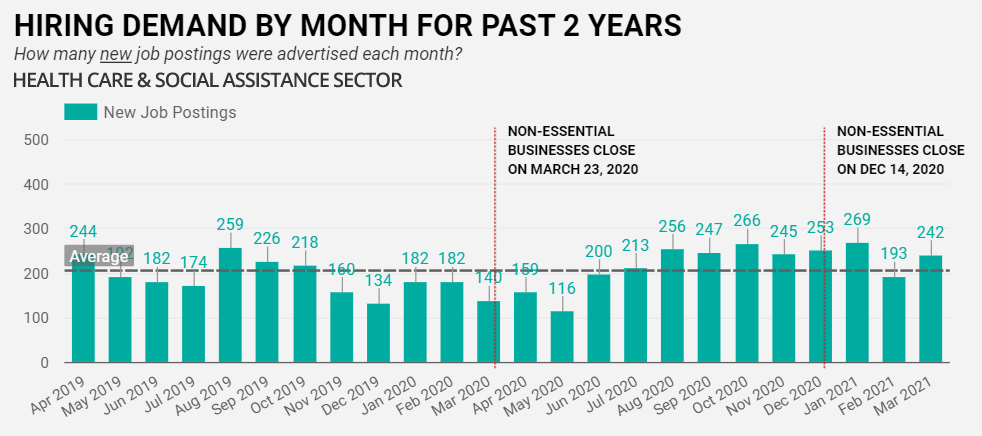

From April 2020 to March 2021, the Job Board saw 2,659 total job postings from 444 companies for the Health Care & Social Assistance sector. This is an increase of 15.96% as compared to April 2019 to March 2020, which saw 2,293 total job postings from 466 companies.

The demand for jobs in the Health Care & Social Assistance sector has increased over the pandemic as compared to the previous year, with January seeing the highest demand in the sector in two years.

While there is a decrease in employment in this sector, there is a significant increase in demand. With serious outbreaks in long-term care homes in the region and the stress and risk of working in the sector at this time may deter people from taking on jobs in the Health Care & Social Assistance sector. Disruptions to immigration stemming from COVID-19 travel restrictions has impacted the sector, as a high percentage of nurse aides and orderlies (41.3%) and specialist physicians (42.8%) in Canada were immigrants, according to the January 2021 Labour Force Survey.

Manufacturing Sector

The Manufacturing sector is comprised of establishments engaged in the chemical, mechanical, or physical transformation of materials or substances into new products. Related activities (such as the assembly of the component parts of manufactured goods; the blending of materials; and the finishing of manufactured products by dyeing, heat-treating, plating, and similar operations) are also treated as manufacturing activities. Manufacturing establishments are known by a variety of trade designations, such as plants, factories, or mills.

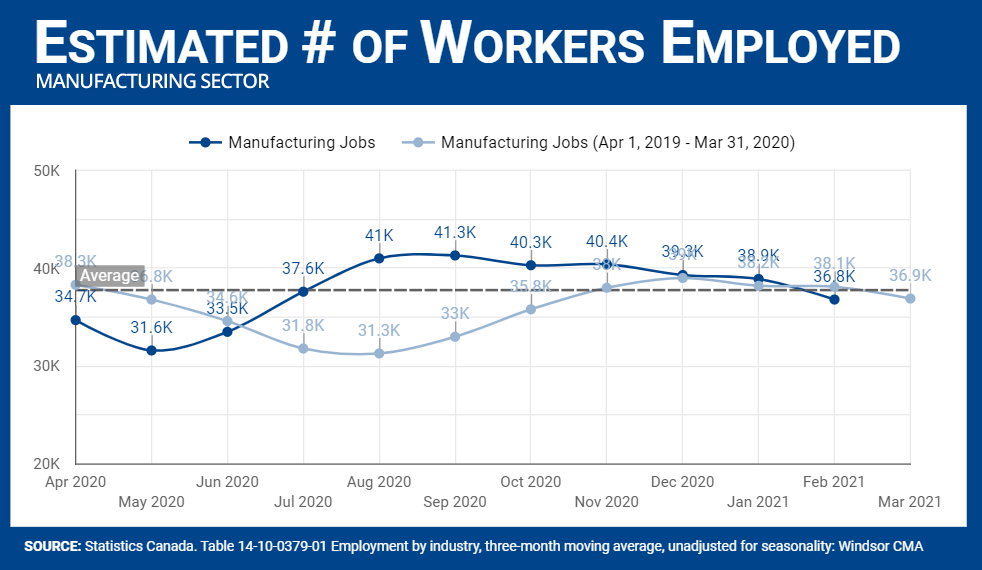

Employment in the Manufacturing sector was below the previous year’s numbers at the beginning of the pandemic, however, as many local manufacturers pivoted to produce Personal Protective Equipment (PPE) and other goods, employment increased significantly over the previous year, although it was 3.53% lower in February 2021 with 36,800 employed in the sector versus 38,100 in February 2020. These numbers would also include various shutdowns and the elimination of the third shift at Windsor Assembly Plant in July 2020 (a loss of 1,500 jobs) and the closures of Nemak in August 2020 (loss of 200 jobs) and JD Norman in February 2021 (loss of 62 jobs).

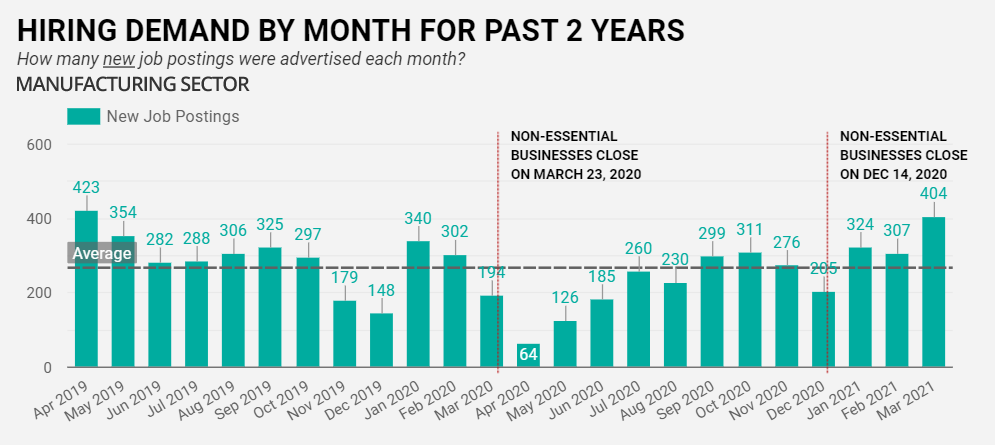

From April 2020 to March 2021, the Job Board saw 2,991 total job postings from 487 companies. This is a decrease of 14.94% as compared to April 2019 to March 2020, which saw 3,483 total job postings from 538 companies.

Hiring demand for the Manufacturing sector has been steady, considering the pandemic’s impacts. The sector was hit hard at the beginning of the pandemic, but steadily increased. It did see a decrease below average in December 2020, but non-essential businesses closed on December 14, 2020, which may have impacted some manufacturing businesses. Holiday shutdowns may also play a factor into the decrease. Demand in December 2020 was 38.51% higher than in December 2019, however, and currently the demand is sitting close to pre-pandemic levels.

As the pandemic goes on, we will continue to see an evolving employment landscape. It is important to keep in mind that the situation is temporary, however the pandemic will have a lasting impact on employment, business, and people as well as their personal habits.

For more information on trends in the labour market on a monthly basis, read our Labour Market Insights blog series.

THE FINDINGS OF THIS REPORT WERE SOURCED FROM:

MONTHLY JOB DEMAND REPORT

ABOUT THIS REPORT:

As of April 2019, the monthly Job Demand Report for Windsor-Essex is created by Workforce WindsorEssex using data collected from 14 unique national, provincial and locally-significant job boards. Between May 2017 and March 2019, job posting data was purchased from CEB Talent Neuron.

MONTHLY JOB SEARCH REPORT

The monthly Job Search Report for Windsor-Essex is created by Workforce WindsorEssex using data collected from four job finding tools, including WEexplore, WEmap jobs, WEjobs board, and the Bridge Timeline Tool. Gender and age information of users is voluntarily shared with the organization.

Questions? Please contact: info@workforcewindsoressex.com.